south dakota excise tax license

In addition to all other license and registration fees for the use of the highways a person shall pay an excise tax at the rate of four percent on the purchase price of any motor vehicle as defined. Message from South Dakota Department of Revenue.

How High Are Spirits Taxes In Your State Tax Foundation

Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax.

. Mobile Manufactured homes are subject to the 4 initial registration fee. System maintenance will occure between 800am CST and 1200pm CST Sunday December 13 2015. 10 10 of the tax liability minimum 1000 penalty even if no tax is due is assessed if a return is not received within 30 days following the month the return is due.

The South Dakota excise tax on gasoline is 2200 per gallon lower then 70 of the other 50 states. All the documents you need to register fast. South dakotas licensing fees help counties pay for road repairs and the state collects a 3 percent excise tax on vehicles purchased and then licensed in south dakota.

Here you can find all the information necessary to start register and license a business in South Dakota. Who This Impacts Marketplace. For more information about obtaining a contractors excise tax license contact the South Dakota Department of Revenue at 445 East Capital Ave Pierre SD 57501-3185.

South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. Sales and excise taxes are two separate taxes that many people pay attention to because they directly affect the price of. If you have any questions regarding the lottery please contact South Dakota Lottery at 1-605-773-5770.

Learn what you need to file pay and find information on taxes for the general public. South Dakota Contractors Excise Tax License bonds are required by The South Dakota Dept. Of Labor Regulation to comply with the state city county or federal government licensing.

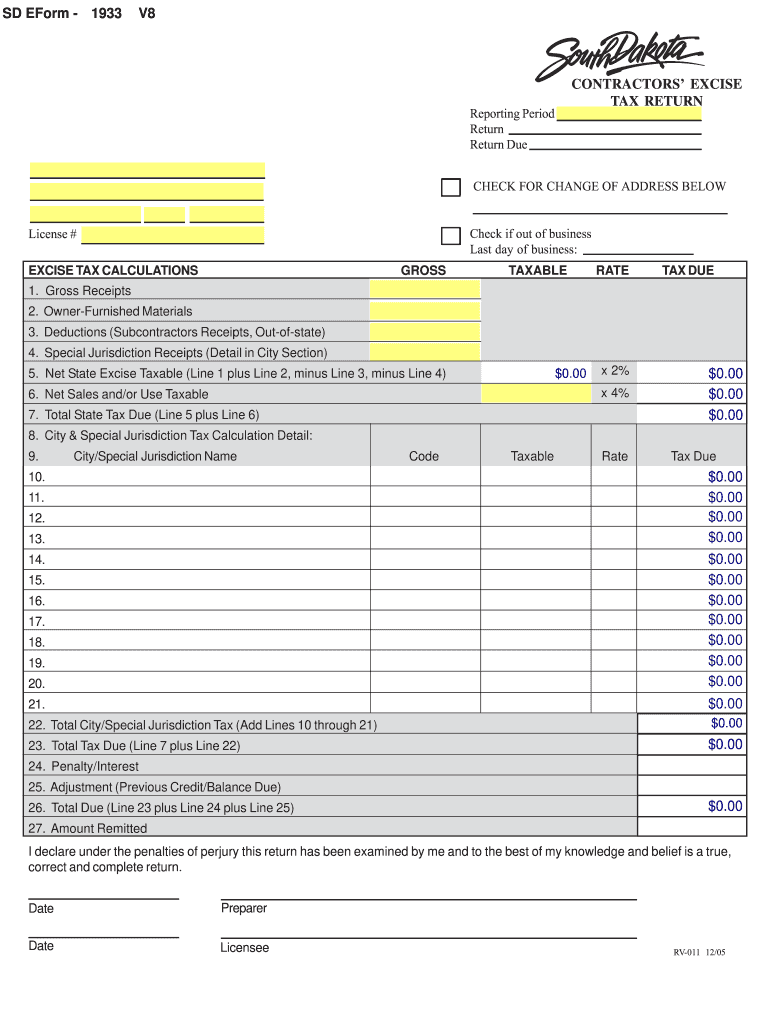

CONTRACTORS EXCISE TAX RETURN License. Chapter 10-35 Electric Heating Power Water Gas Companies. Chapter 10-36 Rural Electric Companies.

Sales and Contractors Excise Tax License Application. South Dakota Department of Revenue 445 East Capitol Ave Pierre SD 57501 How to Apply for a South Dakota Tax License There is no fee for a sales or. Make Checks Payable to.

South Dakota law also requires any business without a physical presence in South Dakota to obtain a South Dakota sales tax license and pay applicable sales tax if the business meets one. If you owe tax and. South Dakota Department of Revenue Regulation Keywords.

In addition for a car purchased in South Dakota there are other applicable fees including registration title and. Contractors excise tax return taxes. The South Dakota Department of Revenue requires all contractors who enter into a contract for construction services to carry a South Dakota contractors excise tax license.

This application allows for the renewal of the following alcohol and lottery licenses. Mailing address and office location. As of March 1 2019 marketplace providers who meet certain thresholds must obtain a South Dakota sales tax license and pay applicable sales tax.

Everything you need to know about games licensing and beneficiaries of the South Dakota Lottery. You can also call. Contractors Excise Tax Return Author.

Chapter 10-33 Telephone Companies including Rural. South Dakotas excise tax on gasoline is ranked 35 out of the 50 states.

Sales Use Tax South Dakota Department Of Revenue

License Requirements For Sales Use Amp Contractors Excise Tax

South Dakota Taxes Sd State Income Tax Calculator Community Tax

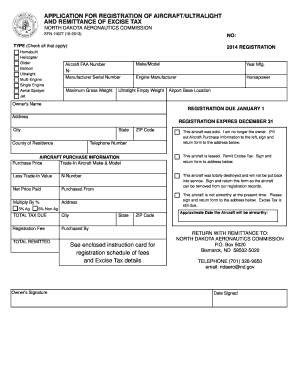

Fillable Online Nd Application For Registration Of Aircraftultralight And Remittance Of Excise Tax Nd Fax Email Print Pdffiller

Taxes South Dakota Department Of Revenue

Contractors39 Bexcise Tax Returnb State Of South Dakota State Sd Fill Out Sign Online Dochub

Economic Nexus Hawaii General Excise Tax And Providing Services In Hawaii Tax Solutions Lawyer

South Dakota License Plate License Plates In South Dakota Dakotapost

South Dakota Guidelines For Sales Tax In Indian Country Avalara

Sales Use Tax South Dakota Department Of Revenue

Nssf The Firearm Industry Trade Association On Twitter South Dakota S Govkristinoem R Has Proclaimed August 2020 As National Shooting Sports Month Acknowledging The Firearm Industry S 346 Million Economic Impact In The State And

License Requirements For Sales Use Amp Contractors Excise Tax

Sales Use Tax South Dakota Department Of Revenue

Beer Taxes In Your State 2019 State Beer Tax Rankings

Printable South Dakota Sales Tax Exemption Certificates

Free South Dakota Tax Power Of Attorney Form Rv 071 Pdf Eforms

South Dakota Sales Tax Guide And Calculator 2022 Taxjar